An article published by Hunt Scanlon Media, May 22, 2024

The private equity landscape has never been more tumultuous. The narrative that once revolved solely around deal volume and value has fundamentally shifted to one where talent is emerging as the key lever for value creation. NU’s CEO and Co-founder Nada Usina talked with Hunt Scanlon about talent trends in private equity.

Last year, PE firms grappled with a contradictory environment. On one hand, deal volumes remained relatively high, indicating a plethora of investment opportunities, and on the other, deal value remained suppressed with a larger value gap between buyers and sellers. The macroeconomic uncertainty was felt throughout the industry, leading to a hesitance around leadership hiring. “As deal volume continued to decline and questions about thefuture persisted, the pace of decision making around executive hires slowed,” explained Alison Woodhead, senior partner at Kingsley Gate. “Mission critical executive searches were still launching, but with an eye toward caution. Hiring managers were simply taking longer to decide how and when they wanted to move forward with key hires. Despite fewer and slower search starts, the market for the strongest PE C-suite talent remained highly competitive, as so many executives made moves during peak deal years post-pandemic. Many of the most desirable, proven executives were firmly entrenched, awaiting exits that were getting further and further pushed out.”

A Challenging Year

“We see a ton of activity when there is a flurry of new investments in new portfolio companies and ’23 was slow on that front,” said Mike Silverstein, managing partner of healthcare IT & life sciences at Direct Recruiters Inc. “Rising interest rates and the impact that had on debt service for deals really had companies focusing on belt tightening last year. There was still a decent amount of search activity, but that activity was highly focused on top grading and replacement of underperforming talent rather than net new initiative hiring.”

McDermott + Bull similarly saw inconsistency and a slowdown in deal flow as valuations fell and expectations on the sell side were reset but were more successful than expected. “High rates affected investment opportunities and banks became very particular on investment criteria,” explained Chris Bull, managing partner and co-founder, Paul Gibbons, managing partner Canada, and Craig Lipus, managing partner at McDermott + Bull. “We saw a lot of PE firms doubling down on developing and upgrading talent. With this said, the year played out to be more positive than we predicted going into it.”

Overall, the year was generally solid as it relates to the PE world, but slightly down year over year. “The flow of opportunities remained relatively consistent throughout the year, with a bit of a slow down during the summer and Q4 when things pulled back a bit,” said Matt Shore, CEO of Steven Douglas. “It was a strange year because M&A activity came to a screeching halt, so new post-acquisition hiring slowed down, but when things got tough at the portfolio company level, our clients were confidentially replacing executives that were not getting the job done to strengthen their teams.”

The broad sentiment around experts in the industry is that though many clients were cautious, those who jumped on talent needs really reaped the rewards. “2023 was a much more tentative year for PE hiring than 2021 and 2022 were,” explained Dana Feller, founder and managing partner of Hudson Gate Partners. “While PE clients were open to backfilling roles that had opened up due to employee attrition, they were much more skittish around adding new talent and expanding teams. PE clients who moved quickly with their hiring were able to secure outstanding talent.” Because of the tighter budget around talent, many focused on optimizing within their portfolio companies, particularly talent that had hit a threshold post pandemic boom. “

At Calibre One, we saw this shift reflected in our search needs,” said partner Victoria Lakers. “Our PE clients prioritized leadership teams adept at driving operational excellence and value creation within portfolio companies. Where we have traditionally been brought in post-acquisition to upskill management, the focus turned to pre-exit leadership. Many clients were seeking executives with proven exit experience across functions, and who would be credible in the function for the acquirers. This year made a strong case for our long-term client relationships where we have worked across multiple portfolio companies.”

“Talent innovation is becoming one of the most powerful private equity value creation levers,” said Sunny Ackerman, global managing partner on-demand talent at Business Talent Group, a Heidrick & Struggles company. “For firms that can provide private equity portfolio companies with access to talent and infrastructure to support their use at scale, it’s also a huge competitive advantage. On-demand talent and interim leaders can enable and accelerate value creation for PE firms in several ways including: smoothing leadership transitions and filling critical gaps, improving performance, and advancing integrations, transformations, and digital initiatives (think AI, cybersecurity).”

Across functions, fractional leaders found increased demand particularly in the PE space. “In an era of rapid change and transformation, interim leadership emerges as the beacon of adaptability, with demand soaring by 23 percent in 2023, and showing strong signs in early 2024,” Ms. Ackerman said. “From steering financial strategies to navigating the digital landscape, interim leaders are the catalysts driving innovation and resilience in every facet of business evolution,” she added.

Notably, PE firms turned to Business Talent Group to fill interim CFO roles (+46 percent YOY) and SVP and VP-level finance talent like controllers and heads of FP&A which surged 114 percent as the expectations of the office of CFO grew in complexity.

The Christopher Group saw similar demand for fractional human resource leaders as well as an increased interest in full time HR leaders, as talent continued to be a key area of focus. “In 2023, we observed a robust and consistent demand from both the private equity firms themselves and companies sponsored by PE for human resource leaders,” according to CEO Nat Schiffer. “Our firm experienced an uptick in both permanent placements and fractional CHROs placements, reflecting the industry’s recognition of HR leadership’s strategic importance in driving post-acquisition value creation. We suspect that this trend is still in the early innings!”

NU Advisory Partners saw significant growth despite a challenging PE environment. “As soon as we started NU Advisory, private equity firms realized that our high-energy, technology-driven business style was ideally suited to their needs,” said Nada Usina, CEO and co-founder. “In our first year, the majority of our search assignments have been for PE firms, including Digital Bridge, SVP global and Onex Partners. They have trusted us to recruit CEOs, CFOs, CROs, board directors, and other senior leaders for their portfolio companies.”

“OMERS Private Equity, the $23 billion affiliate of a large Canadian pension fund, had rolled up two dozen HVAC companies into a new entity called Modigent. They turned to us to hire the human resources leaders who could manage this explosive growth,” says Ms. Usina. “In just a few months, we recruited Susana Sala, who held senior HR roles at Paramount Global and Bacardi, as chief people officer and then filled in her entire leadership team.”

Shift Towards Assessing and Upgrading

Given the macroeconomic climate, rather than building out teams, firms were primarily recruited to evaluate, optimize, and strengthen talent.

“We saw continued growth in our activity recruiting portfolio company leadership positions,” said Chris Smith, partner at Leathwaite. “While deal volumes have been down and hold periods extended, our work has been driven largely by four areas: replacing or strengthening leadership teams particularly when it comes to carve-out situations; PE firms spending an increased amount of time assessing and upgrading existing leadership teams; strengthening operating partner and value creation teams; the need for fractional and interim executives through periods of change and transformation.”

Many firms experienced the shifting needs of clients over the past year. “Whereas scaling and building experience had been in high demand in previous years, last year we advised clients to consider shifting to a much more operationally-focused and financially-rigorous target profile across all functional roles, whether that was for CFOs, HR leaders or other key leadership roles,” explained Mayank Parikh, managing partner, tech and private equity practices at Hanold Associates.

“While the U.S. PE market was certainly slower in terms of new deals, our diverse range of clients were still making strategic hires into existing investments as well as (selectively) staffing up their portfolio operations groups,” explained Harry Chamberlain, head of North America private equity and Mark Fagan, managing director, EMEA private equity at The Barton Partnership. “Despite the ongoing absence of significant new deal and exit activity in EMEA, 2023 was still busy as everyone hunkered down on driving value creation within the existing portfolio. We also observed a shift in focus from the post-COVID quest for growth – often not profitable, particularly in tech – to a substantial re-focus on cost, company rightsizing, operational improvement, and efficiency, with pricing remaining a constant theme,” the two continued.

The Evolution of PE Talent Strategy

Talent has always been a top priority for PE firms as they build out teams for their portfolio companies. “This is even more evident today,” said Kate Portland, SVP & practice leader, private equity at Slone Partners. “A great business will only succeed with the right team. Ensuring that precise talent is in place from the outset– whether it’s the existing leadership team or a new one – is critically important to take the company to the next level.” With talent’s true value understood, the importance of executive search firms becomes increasingly evident. “As a PE talent leader recently said to me, ‘I know a lot of people, but I don’t know them all,’ and with money to invest sitting there, when a PE firm does not have the leaders to drive growth, deals are lost,” said Janice Ellig, CEO of Ellig Group. “PE leaders know that value creation has evolved from just revenue growth, margin optimization and financial leverage to having the critical talent and leadership of that talent as a top priority and critical driver of growth.”

Finding Specialized Experts

This prioritization of talent includes finding the right leaders, as well as specialists who are experts in their field. “We’ve witnessed talent strategy for PE firms evolve significantly over the past 10 years driven by various factors such as changes in the industry landscape, technology advancements, globalization, and shifting investor expectations,” said Steve Ziegler, founder and managing partner of Z3 Talent. “There’s been a growing emphasis on specialized skills and expertise within the private equity sector. As the industry becomes more complex and competitive, firms are seeking professionals with deep knowledge in specific sectors, such as technology, healthcare, or energy. This trend has led to the hiring of professionals with diverse backgrounds, including industry specialists, consultants, and operational experts.”

“The PE strategy for talent has evolved to require more of an entrepreneurial mindset as companies have been asked to slow their burn and elongate their runway,” said Mike Silverstein, managing partner and executive search leader of DRI’s healthcare IT division & life sciences practice. “Leaders are being asked to do more with existing products by identifying ancillary markets and new distribution channels that allow for growth without impacting the cost of goods sold. There is a premium being put on folks that really understand the markets they are jumping into (more emphasis on previous domain expertise) rather than looking for athletes that come with transferable skills from other industries that may require more time to ramp up on the domain.”

Considering Talent Earlier in the Deal

The importance of talent for PE firms is becoming evident much earlier into the deal-making process as well: “A recent Bain & Co. study underscores this shift, crediting talent with a significant 71 percent of deal success,” said Victoria Lakers, at Calibre One. “PE firms are no longer waiting until after an acquisition to address leadership. They’re proactively seeking high-caliber talent pre-acquisition, during the crucial first six months of ownership, and again as they prepare for exit. This multi-stage approach emphasizes talent as a core driver of investment returns. Furthermore, PE firms are raising the bar for talent acquisition. They increasingly recognize that the quality of the C-suite can significantly impact value creation, potentially making the difference of hundreds of millions in investment returns.”

Using Search Firms for HR Talent

“We are also seeing a more holistic approach to the human element of portfolio companies,” said Mr. Herman. “It is becoming less about just upgrade and placement and more about understanding corporate culture and how that drives performance. We are seeing broader adoption of assessments, executive development plans and deeper involvement of the fund in the HR function.”

While traditionally PE firms have used executive search firms to find leaders for their portfolio companies, now a key priority for portco success is locking in the talent strategy. “We are seeing private equity firms putting a greater emphasis on recruiting experienced leaders for their talent management and HR functions,” explained Ms. Usina. “Traditionally, PE firms focused mainly on CEO and financial positions. And they still put a premium on hiring people with a track record of operational excellence. Now, they also see how important their people strategy is to the success of their portfolio companies. Many have to integrate multiple acquisitions. And at the same time, they may be restructuring their workforce with all the disruptions that can cause.”

This often means there is a partner within the fund who works with the executive search consultant to build a talent strategy. “Funds are having to be much more proactive in talent pipelining in order to stay ahead of the competition,” said Harry Chamberlain and Mark Fagan at The Barton Partnership. “This is driven by the rate at which PE portfolio companies are growing, which outstrips the number of candidates with truly successful portfolio company experience. Funds have become more systematic in their approach to talent pipelining and the assessment of new hires. The emergence and growth of the talent ops partner we have seen over the last 18 months is testament to this.”

Utilizing a Talent Partner

As PE firms continue to prioritize talent internally and at their portcos, they are increasingly hiring a human capital firm to bring in new talent and leveraging existing talent. But an additional trend is to hire an internal talent advisor. By doing so, PE firms can measure internal talent progress, leverage talent learnings, and build a talent pipeline so that the firm can learn how to foster talent from within the company. Additionally, talent advisors often have experience with coaching, increasing board diversity, and helping with other initiatives necessary for the PE firm.

Talent strategy has evolved significantly for PE sponsors as they increasingly embrace talent as a critical driver of value creation. “This is especially true without the financial engineering options typically afforded sponsors,” explained Zack Demining, managing director, aviation, transportation & logistics at Diversified Search Group. “One of the main areas where we’ve seen firms evolve is the proliferation of the head of talent acquisition role. Once primarily the purview of larger firms, we’re seeing this role move increasingly into mid-market/lower mid-market firms.”

“Operating partners are playing a much bigger role in talent decisions,” Mr. Demining continued. “No longer used for just their due diligence capabilities, operating partners today are playing a bigger part in candidate assessment, culture alignment, and role definition/job spec creation. As previous operators themselves, many are helping sponsor/HR teams better define what’s actually needed in critical roles. These partnerships are deeply collaborative, where joint efforts between internal talent advisors and external human capital firms are deployed to ensure the right talent is at the helm of each investment, aligned with the strategic vision, and capable of realizing its potential.”

Keeping Recruiters Busy

PE firms are laser-focused on finding specific domains and industry expertise to fit the unique culture and environment of their investments, according to Matt Hamlin, managing partner at PierceGray. “On top of background and sector knowledge, identifying candidates with demonstrated flexibility and adaptability to operate in a fast-paced and dynamic environment shrinks an already limited pool of talent,” he said. “While past success can often predict future success in this sector, the number of potential candidates with previous successful private equity experience and expertise is even more constrained, creating a highly competitive search for top talent.”

“Organizations and PE firms often face challenges in retaining talent due to factors including limited career advancement opportunities, lack of work-life balance, or inadequate compensation,” he said. “Identifying the right candidate poses its own unique challenges; however, retaining talent is just as important as recruiting talent.” PierceGray has seen a shift in the types of roles that are currently in demand and expect these trends to continue. “We’ve seen an uptick in demand for private equity operations roles at the fund level as PE firms look to invest in resources that will drive cost out of their portfolio companies as growth may be more constrained in this challenging environment,” said Julia Dashuta, a managing director with PierceGray. “Many of the operating partner and other cross-portfolio executive roles have skewed toward functions with cost-out impact, such as procurement and operational excellence as opposed to growth-oriented roles in past years.”

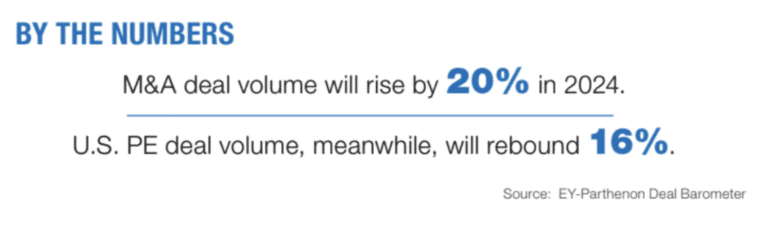

“At the portfolio company level, we’ve seen an increase in demand for supply chain and procurement leadership talent as companies continue to work through the supply challenges from the pandemic and increase their focus on driving cost savings and operational excellence in this uncertain market,” said Ms. Dashuta. “In spite of the current market uncertainty, there is reason to be hopeful for the future of PE/VC in both the medium and long term. The PE market is resilient, and dry powder is at an all-time high, with PE firms ready to invest when market conditions improve. Many of our private equity clients are optimistic about a turnaround expected next year.”

By leveraging the talent within their portfolio companies effectively, private equity firms can create value beyond financial engineering, driving operational excellence, innovation, and sustainable growth across their investment portfolio,” suggested Mr. Ziegler. “Encouraging cross-portfolio collaboration and knowledge sharing among portfolio companies, creates innovative solutions and operational ideas. “Facilitate forums or networking events where executives and key personnel from different portfolio companies can exchange ideas, best practices, and lessons learned.”

Additionally, by implementing performance benchmarking across portcos, PE funds can compare operational performance against industry peers to identify strengths and opportunities. “Foster a culture of innovation and collaboration within the portfolio by encouraging R&D initiatives, partnerships, and joint ventures,” Mr. Ziegler added. “By creating platforms for sharing innovative ideas, technologies, and intellectual property among portfolio companies, the fund drives synergies, and unlocks new growth avenues.”

The Role of an Operating Partner

While each firm tends to be different, operating partners are increasingly involved in the hiring of executives and in many cases driving the process. “While always involved in the executive hiring in the past, we are seeing them get involved with search mandates a level or two down from the C-suite and driving the process of bringing in interim executive talent,” said Mr. Shore. “Operating partners have a unique vantage point as they understand the investment thesis and what needs to be accomplished and they also get a good sense for what the portfolio company is great at and where the gaps are, since they are involved in various initiatives.”

“It has been said a million times – private equity is in the talent business,” said Allison Woodhead, senior partner at Kingsley Gate. “The best operating partners focus the majority of their energy on building and supporting high-performing leadership teams. They touch every aspect of talent management in the portfolio, from org design through recruitment, development, and succession planning. Moreover, the operating partner role becomes even more crucial when taking bets on high potential step-up CXO talent, which has become an increasingly attractive path for PE teams as the war for talent rages on.

Operating partners are well positioned to coach, guide and develop mission critical leaders as they navigate key decisions and drive performance.” Operating partners also play a key role in identifying strengths and weaknesses as well as broader talent management throughout the portfolio companies. “They provide guidance and support for leadership development initiatives, offering mentorship, coaching, and training programs to enhance executives’ leadership skills and drive performance improvements,” explained Mr. Schiffer. “They also assist in developing robust succession plans for key leadership positions, ensuring smooth transitions during leadership changes or organizational growth phases. Collaborating closely with portfolio company management teams, operating partners address performance issues and implement corrective actions as needed, drawing on strategic insights and operational expertise to drive performance improvements and enhance business efficiency.

“Furthermore, operating partners leverage their extensive networks and industry connections to facilitate talent acquisition efforts, guiding recruiting strategies and talent retention initiatives to attract and retain top talent within portfolio companies,” Mr. Schiffer added. “Overall, operating partners play a vital role in maximizing the potential of portfolio talent and driving value creation within PE- backed companies.”

This evolution of the role of operating partners means that increasingly human capital firms work hand in hand with operating partners to execute strategies. “In the Modigent search, we worked with an advisor to OMERS who had been the CPO of a major public company,” said Ms. Usina. “He played a critical role in advising management, meeting candidates, and helping recruit them for the opportunity. Of course, having more people involved does make an engagement more complex; you are not just dealing with the portfolio company management, there are the general partners, the operating partners, and often, outside consultants.”

“Ultimately, that’s part of what makes working with PE firms so addictive,” Ms. Usina continued. “Yes, it’s more complex, and the pace is faster. But once you understand the approach, you get to work with fascinating people who have so much experience. You can learn a lot from their perspectives. They truly value our ability to connect the dots and our ability to go deep in areas of expertise around this most critical asset, their people!”

Operating partners within PE firms leverage extensive industry networks to facilitate connections between executive talent and portfolio companies. However, despite their influence, portfolio companies largely maintain autonomy over their management strategies, though indications suggest increased PE fund involvement in 2024. Furthermore, family offices are increasingly embracing direct investments in private equity alongside traditional PE fund investments.

“This diversification reflects a dynamic investment strategy focused on optimizing returns and gaining more direct control over investment decisions” said Julien Rozet, CEO of Alexander Hughes. “As the private equity landscape continues to evolve, executive search firms remain crucial partners, poised to adapt to facilitate the alignment of top-tier talent with the evolving needs of PE firms and their portfolio companies, thereby driving continued growth and innovation in the sector.”

Seeking Talent Synergy

Rather than shoehorning the fund’s talent into portfolio companies, the emphasis is on cultivating environments within portfolio companies that attract and retain the best possible executives. “PE firms have no shortage of good talent to choose from. Cultural fit separates good talent from the right talent,” explained Robin Judson, founder of Robin Judson Partners.

“Funds need candidates whose vision, strategy, and approach to problem-solving aligns with the broader organization as a disconnect in team vision and approach can create miscommunication and conflict. Firms need to trust that their employees will take initiative and make decisions in keeping with the goals of the organization. Culture fit, as a result, is no small part of the PE recruiting process. It is one of the most important aspects of how firms make distinctions among the many talented candidates they interview.”

While it varies by firm, when evaluating for culture fit, it is important firms look beyond technical skills and take into consideration personality and approach to work, as well as communication style and interpersonal relationships. “Firms hire in the hopes of retaining talent over the long term,” Ms. Judson said. “When personalities clash, staff retention can suffer. It is also important for prospective staffers to understand that culture is a two-way street. Firms don’t want to hire candidates that won’t add to their team; candidates shouldn’t want to be at those funds either. This involves a more comprehensive understanding of the company’s culture, values, and strategic imperatives and aligning them with the aspirations and expertise of the incoming talent. By fostering an organic synergy

between the culture of the portfolio company and its leadership, private equity firms aim to cultivate a fertile ground for sustainable growth and innovation,” Ms. Judson continued.

AI and Private Equity

In PE-backed companies’ current landscape, AI integration is not just a trend but a strategic pivot towards innovation and competitive differentiation. “Private equity firms’ growing interest in appointing chief AI officers highlights their commitment to leveraging AI at the executive level,” said Natalie Ryan, partner at SPMB. “I’ve seen the surge in VP partnership roles, specifically aimed at fostering collaborations with AI platforms, underscores a proactive approach toward embedding AI in product development. This strategy enables companies to gain early insights into upcoming AI technologies, allowing them to tailor their offerings more effectively and secure a competitive edge.”

“Beyond tech, industries traditionally backed by PE firms—finance, healthcare, manufacturing, and retail—are increasingly recognizing the imperative of AI in maintaining market leadership too,” Ms. Ryan said. “This recognition has already translated into substantial investments in AI applications, driven by the need to innovate, enhance operational efficiencies, and personalize customer experiences. Consequently, there has been a growing demand for specialized AI talent, including data scientists, machine learning engineers, and AI researchers.”

“These roles are critical in developing and implementing AI strategies that align with the companies’ long-term visions and are often integrated within the broader technology leadership framework, reporting to the chief technology officer, chief data officer, chief digital officer, or chief information officer, depending on the organization’s specific needs and technological infrastructure,” continued Ms. Ryan. “Given these developments, it’s clear that PE- backed companies are not only anticipating but actively contributing to a surge in AI-focused hiring. This trend is expected to accelerate in the coming years as AI becomes an indispensable element of competitive strategy across various industries.”

Seeking Talent for Portfolio Companies

“Over the past several years, private equity has focused most intently on areas of the insurance industry that are less balance sheet/asset intensive than acquiring a property & casualty or life insurance carrier,” said Craig Lapham, CEO of insurance-focused The Lapham Group. “To that point, PE sponsors have primarily focused on distribution oriented companies to include insurance brokers and managing general agents (MGAs). This focus also includes investment in data/analytics driven and technology enabled businesses that provide disruptive innovation and support around risk management to include the development, distribution and administration of risk mitigation products and services.”

“Across these insurance industry portfolio companies, PE sponsors are consistently seeking sophisticated CEO/president/COOs, CFOs and CTOs who can develop the necessary infrastructure to support ongoing profitable growth,” he said. “This becomes particularly relevant given the relentless pace of M&A within the brokerage/ distribution sector of the insurance industry. There are PE-backed insurance brokerage platforms that have conducted hundreds of acquisitions which has driven exponential growth, but as interest rates rise with a corresponding slowdown in M&A, there is a real need for operational, financial and technology leadership to lead the necessary centralization of operating infrastructure and systems to ensure the company can drive consistent profitable organic growth going forward.”

The biggest talent acquisition challenge facing PE portfolio companies within the insurance sector is identifying, attracting and retaining a unique profile of executive with the relevant operational and financial skill set and experience base combined with the personal attributes and leadership skills required to succeed in a PE- backed environment, according to Mr. Lapham. “This includes the ability to thrive in a demanding and fast paced corporate environment with ongoing business transformation,” he said. “Linear thinkers and those seeking highly structured environments in purely maintenance roles will not succeed. This also requires executives capable of rolling up their sleeves and managing like an owner within rapidly growing entrepreneurial environments. Trends for PE/VC firms within the insurance sector will include greater focus on driving sustainable organic growth within their portfolio companies vs. inorganic M&A,” Mr. Lapham said.